To comply with regulation, financial intermediaries across the world are typically required to take ‘appetite for risk’ into account when assisting with a client’s investment decisions. Risk Appetite is a disarmingly accessible and intuitively meaningful term. But, as with most colloquialisms, pinning down a precise enough definition for operational purposes is not a simple matter. The level of specificity that is sufficient for casual discourse looks decidedly fragile in the context of accountable policy making within a strict regulatory framework. According to an early definition from the UK Financial Services Authority (FSA):

“Risk appetite is the amount of risk that one is prepared to accept, tolerate, or be exposed to at any point in time.” (2006).

A number of assumptions are inherent in this regulatory mission: firstly, that the clients themselves have a clear idea what their risk appetite is and can articulate it; and secondly, that their Financial Advisor will be able to interpret it in terms of product suitability.

Problems of communication

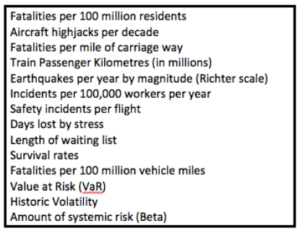

Risk measurement is never entirely objective, but underwriters, actuaries and quants seek objectivity in a world of numbers, statistics, mathematical models, and algorithms. In the world of finance, risk is calculated. As intermediaries, Financial Advisors (FAs) understand financial products in similar terms. This statistical approach is referred to as ‘objective risk assessment’.

Individuals, on the other hand, know a great deal about risk from their own life experience. Everyone deals with risk on a minute by minute basis, reacting heuristically and according to their own risk dispositions and there is often a mis-match between what they consider high risk and what the statistics suggest. Individuals perceive risk and react to it differently; we each have our own risk antennae. Dispositions like these are evident in everyday decision making; the way we cross the street, the way we plan our holidays, monitor our expenditure, behave at parties, manage our relationships, spend our leisure time, organise our work, react to unexpected events. There is a consistency amongst all this and, in broad terms, people are predictable in their approach to risk – it will be one of their most prominent characteristics. But this is a very different perspective on risk to the models and algorithms of the financial world. Nevertheless, it is clearly the basis of a person’s risk appetite. We refer to this more intuitive approach as ‘subjective risk assessment’.

‘Objective risk’, then, is data driven and involves a combination of sophisticated statistics, model making and expert judgement. ‘Subjective risk’ is risk as we actually feel it, experience it and act on it. Subjective risk is often questioned and criticised because it is at odds with the statistics and calculated probabilities, but this is what a person feels and experiences, this is their risk appetite. These worries and anxieties or seemingly unaccountable daring are in their nature; they cannot just be swept aside as ‘irrational’.

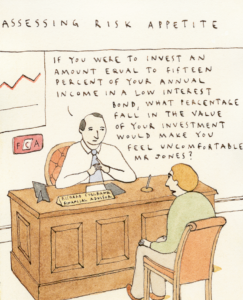

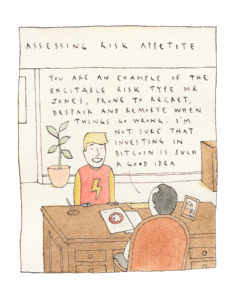

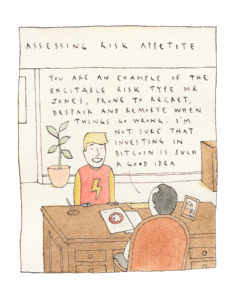

Financial professionals have responded to the regulatory requirement to assess Risk Appetite with a wide and varied range of questionnaires. Naturally enough, these were framed by the industry’s objective approach to risk. Customer engagement in the process is therefore very much on the terms of their advisor and the objective approach to risk that they are familiar with.

Financial Advisors cannot be expected to add coaching psychology to their skill set, but, if the goal is to match investments to the client’s risk appetite, they need an approach that facilitates a better balance between their own professional framework and the risk perceptions of their clients. To add to the complexity, few clients will be able to clearly articulate their own risk dispositions because they operate for the most part at an unconscious level, steered by the heuristic principles and intuitions that they have developed.

The challenge

This is precisely the challenge addressed by Risk Type. This is a framework based on consensual neurology and personality psychology research and it provides a very accessible and easily communicated model that is informative for clients and their advisors.

First and foremost, financial advising helps clients to make good, responsible decisions in the face of uncertainty – decisions in which the client knows the score, both in objective risk terms, and in terms of a grounded and perceptive understanding of their own risk dispositions. Our understanding of decision making is at the core of the Risk Type model.

There are two neurological processes at work in decision making:

“Decision-making draws on both the analytical and the emotional systems in the brain”

From “INNOVATION Managing risk, not avoiding it”

Annual Report of the Government Chief Scientific Adviser 2014.

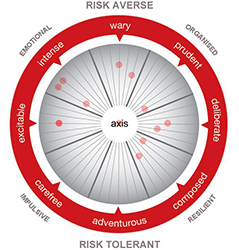

On the emotional side, every individual falls somewhere between the fearful, pessimistic, apprehensive end of the scale, and the confident, optimistic, imperturbable end. The analytic or rational dimension is about a need for understanding, coherence and certainty. At one end of the scale, people are controlled, conventional, prudent, systematic and deeply discomforted by uncertainty. At the other end, are those attracted to novelty and excitement challenge convention and are open minded, adventurous and unconcerned about details. Again, everyone will fall somewhere between these two extremes.

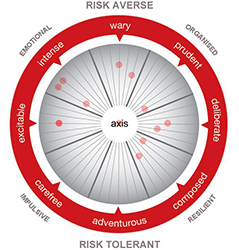

Psychometric measures, based on the analytic and emotional parameters, confirm that they are independent of each other (Diagram A). Arranged orthogonally, they define the ‘compass points’ for a continuous 360o spectrum of risk dispositions.

Many people will be placed close to an extreme on both scales and the additional four intermediate Risk Types (diagram B) represent people that are influenced by both the neighboring Risk Types. For example, the Wary Risk Type at the top has two reasons to be risk averse; they are fearful (Intense) and they are troubled by uncertainty (Prudent). Similarly, at the bottom of the compass, the Adventurous Risk Type has two reasons to be risk taking; they are both excitement seeking (Carefree) and they are fearless (Composed).

For practical convenience, then, the 360o gradation of risk dispositions can be segmented into 8 distinct Risk Types reflecting the range of possible combinations of emotionality and rationality. This is the ‘shape’ of subjective risk, or human factor risk. It differentiates people in ways that they recognize, that their colleagues and partners recognize and that provides accurate description of teams, professions and organizations. You are no more likely to encounter one Risk Type than any other because in the wider population, there are very evenly represented. However, within different professions and organizations, the balance of Risk Types can be very distinctive. Risk Type is a remarkably good differentiator and, as the following examples show, it has real life consequences.

Essentially, risk appetite is a consequence of individual differences in personality. For some, risk taking is simply a consequence of being relaxed and easy going and not taking enough care; for others it is their need for excitement that gets them into trouble, or perhaps not adhering to rules, not bothering to plan ahead or research decisions, being impulsive or spontaneous, or just because they like to do things differently. Alternatively, for some, risk taking is more about missed opportunities. They miss the boat because they are inflexible, excessively anxious or troubled by uncertainty; too rule bound to see other possibilities or because they fear failure.

The diagram above gives an indication of the scope and utility of Risk Type and the specific focus for each. Risk Type Compass reports describe the risk appetite of clients comprehensively and in terms that are immediately meaningful. The language articulates a clear and coherent framework from which to consider “the amount of risk that one is prepared to accept, tolerate, or be exposed to at any point in time” (FSA, 2006). Clients appreciate the insights that are brought into focus by this process. They are offered an account that is consistent with personal experience. The model is also very easily assimilated into FA practice. Intermediaries quickly become familiar with the typology and are able to facilitate clients in their decision making. Armed with the self-knowledge afforded by their Risk Type assessment, clients become more than ‘bit part actors’ in the process and are able to contribute and play a full part in the discussions that are clearly all about them.

The FA’s task has often assumed a style of customer education, simplifying the complexities of the market for the benefit of the financially naïve. The typical ‘how would you feel if…’ scenario questions that are so prevalent are not a helpful way to develop client insight. This approach stems from the presumption that the task is to initiate the client in the ways of finance. That is partly true but it is not the crux of the matter. There can be no meaningful discussion without establishing a consensual understanding about the client’s risk dispositions and their implications. This is surely necessary for both parties if they are going to play their respective parts fully? This is a mutually beneficial process that establishes a purposeful and professional basis for fruitful collaborative relationships.

Geoff Trickey, 2018